Biotech company Origenis welcomes Prof. Hendrik Liebers as Chairman of the Board

The industry expert will play a key role in supporting the company’s strategic development

July, 2023

© Pieris

The Lungs

© Pieris

Stephen S. Yoder, CEO, Pieris Pharmaceuticals Inc.

© Origenis

Prof. Hendrik Liebers, Chairman Origenis

„Unser Team entwickelt mit großer Leidenschaft hochinnovative Therapeutika für Haustiere, um die Lebensqualität unserer vierbeinigen Gefährten und ihrer jeweiligen Besitzer deutlich zu verbessern. Wir freuen uns, heute mit einem so erfahrenen Partner bei der Entwicklung von therapeutischen Antikörpern für Haustiere zusammenzuarbeiten, um die Innovation in der Tiergesundheit weiter voranzutreiben.“

Dr. Kathrin Ladetzki-Baehs

Gründerin und Geschäftsführerin, adivoG

Origenis is a technology platform-based biotech company located at the IZB that conducts research on novel, small-molecule drugs against various diseases, especially of the central nervous system, and drives their development and commercialization through spin-outs. Origenis currently employs approximately 30 people and operates its own laboratories at the IZB. With his appointment as Chairman of the Board, industry expert Prof. Hendrik Liebers will significantly support the emerging biotech company in Martinsried near Munich in its strategic development.

Liebers has been active in the biotech industry for more than 25 years. During this time, he has worked for various VC funds and served as managing director, board member and supervisory board member of several companies in the fields of pharmaceutical development, diagnostics, industrial biotechnology as well as agrobiotechnology. During this time, he has participated in more than 30 M&A and licensing transactions as well as financing rounds in Europe, the USA and Japan. As CFO of Probiodrug AG, he also structured and implemented an IPO on Euronext in Amsterdam and several subsequent PIPE’s. Hendrik Liebers is currently co-shareholder of several biotechnology companies and serves on various supervisory and advisory boards. In addition to his business activities, he holds a professorship of business administration at Mittweida University of Applied Sciences.

“We are very pleased to welcome Prof. Liebers, an excellent expert in the scientific as well as in the business field, as Chairman of the Board of Origenis. As an experienced manager and expert in the biotech and pharma scene, he enriches our team with his valuable expertise and supports us in strategic implementation,” said Dr. Michael Thormann, CEO & CSO of Origenis.

“Origenis has built a world-class technology suite and expertise in medicinal chemistry over a period of more than 15 years. There are only a handful of companies in the European biotechnology landscape that are on par with Big Pharma here – Origenis is part of that club. Building on this, we intend to focus increasingly on generating highly innovative and clearly differentiated development programs, which we will progress and fund in separate, asset-centric units. As Chairman, I am pleased to support the management, the staff and the shareholders in this exciting and challenging process,” so Liebers about his new role.

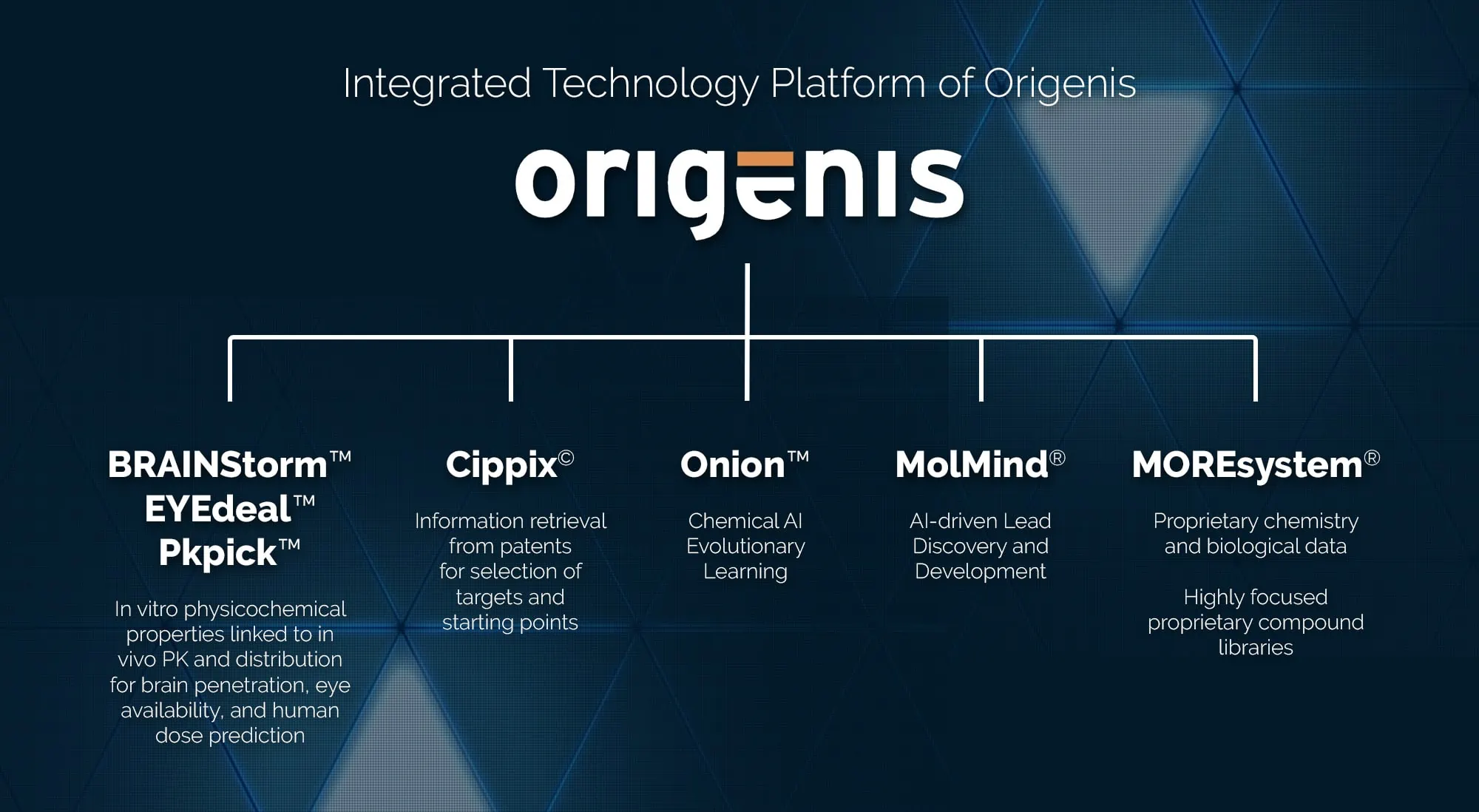

Identification and analysis of innovative targets via technology platform

Origenis has an integrated technology platform ranging from identification and analysis of innovative targets, design of lead structures/lead structure classes directed against these targets, their pharmacokinetic and metabolic optimization, to patentability searches. A special component of this technology suite is the ability to specifically design the crossing of the blood-brain barrier – and the whole thing is largely automated and self-learning. Only substances that have overcome these hurdles and undergone optimization processes are then synthesized by the in-house chemistry department and further analysed in the BRAINstorm® platform. This integrated platform allows Origenis to create its compound programs very broadly and deeply. This means that the selection of the final development candidates is well-founded – as thousands of substances are generated and analysed according to all relevant parameters before focusing on fewer and fewer, namely the most suitable compounds. Of course, this does not reduce the risk inherent in pharmaceutical development – but it can efficiently prevent false negatives – i.e., the right target and the right approach, but unfortunately insufficient development substances. And it is precisely the latter that is catching up with many biotechnology companies. They have selected the compounds for development from a pool of very limited chemical diversity and insufficient optimization, necessarily making (too) many compromises. And when they then compete against companies that select their development candidates from a broad and diverse pool, they usually lose.

© Origenis

Integrated Technology Platform of Origenis

The results of Origenis’ technology platform speak for themselves.

“We’ve already transferred the second development program into a spin off, and next year we’ll get to work on separately funding and staffing that company,” says Liebers. This is a program to specifically inhibit CDK9 and CDK2 (cyclin dependent kinases 9 and 2), an approach being pursued by the pharmaceutical industry with an increasing number of development programs to treat various cancers as well as viral infections. Origenis has generated a comprehensive, well characterized compound pool, the first of which is already in regulatory preclinical development and is expected to be clinics-ready next year. The company has the only CDK9/2 compound platform that is highly potent, extremely selective and with the ability to cross the blood-brain barrier, opening up access to therapies also for forms of cancer and viral infections in the brain.

Incidentally, the first spin-off is Neuron23 in San Francisco, which was initiated by Origenis and equipped with the appropriate compounds. Of these, NEU-723, a best-in-class LRRK2 inhibitor for the treatment of Parkinson’s disease is already in clinical development; NEU-411 – a second LRRK2 inhibitor is expected to start this before the end of 2023. Meanwhile, Neuron23 has raised more than USD 200 million from the who’s who of the financial industry, such as SoftBank Vision Fund 2, Westlake, Kleiner Perkins, Perceptive Advisors, Cowen Healthcare Investments, Redmile Group, HBM and Surveyor Capital. And consideration/preparation for a third spin-off in oncology is already underway.